Read the letter

A FIRST CLASS OPPORTUNITY

Click play to have the letter read aloud to you!

Dear Homeowner,

This is a weird way to start a letter, but this might be the most honest letter you’ll ever receive…

Your lender sent you some bad news—a lis pendens—and suddenly, your mailbox is bursting at the seams. It’s all these warnings, and “urgent” letters that seem more alarming than helpful. It sucks, but we get it… and believe it or not, we’ve been there ourselves. It might feel like your whole world has been shaken and everyone is shouting at you about what to do next. Take a deep breath. This letter is different. We’re not here to add to the noise. We’re here because we know the fear and uncertainty that comes with the threat of losing your home. In times like this, you don’t need noise. You need genuine help and ideas.

But First, Why the Heck

are You Getting All This Mail?

Ever since that lis pendens notice arrived—a public record stating that your home is facing foreclosure—it's as if you've been thrust onto center stage. You’re popular, but not in a cool way! Your phone won’t stop buzzing with calls from unfamiliar numbers, your mailbox is jam-packed with all these 'urgent' solutions, and it's only a matter of time before the doorbell rings with eager strangers. (Yes, we’ve seen that happen!) All these 'We Buy Houses for Cash' investors are swarming like sharks to a shipwreck, drawn by the public announcement of your distress. The truth is, they are far from the helping hands they claim to be, and many are in it to profit from your hard times. Warning, these people are the scum of the earth looking to prey on those in need. We've seen good folks like you get overwhelmed, unsure of who's tossing them a lifeline or who's actually trying to drown them. Our purpose is to cut through this racket and offer genuine help and clarity for your situation—without ulterior motives.

Will I Get Foreclosed On?

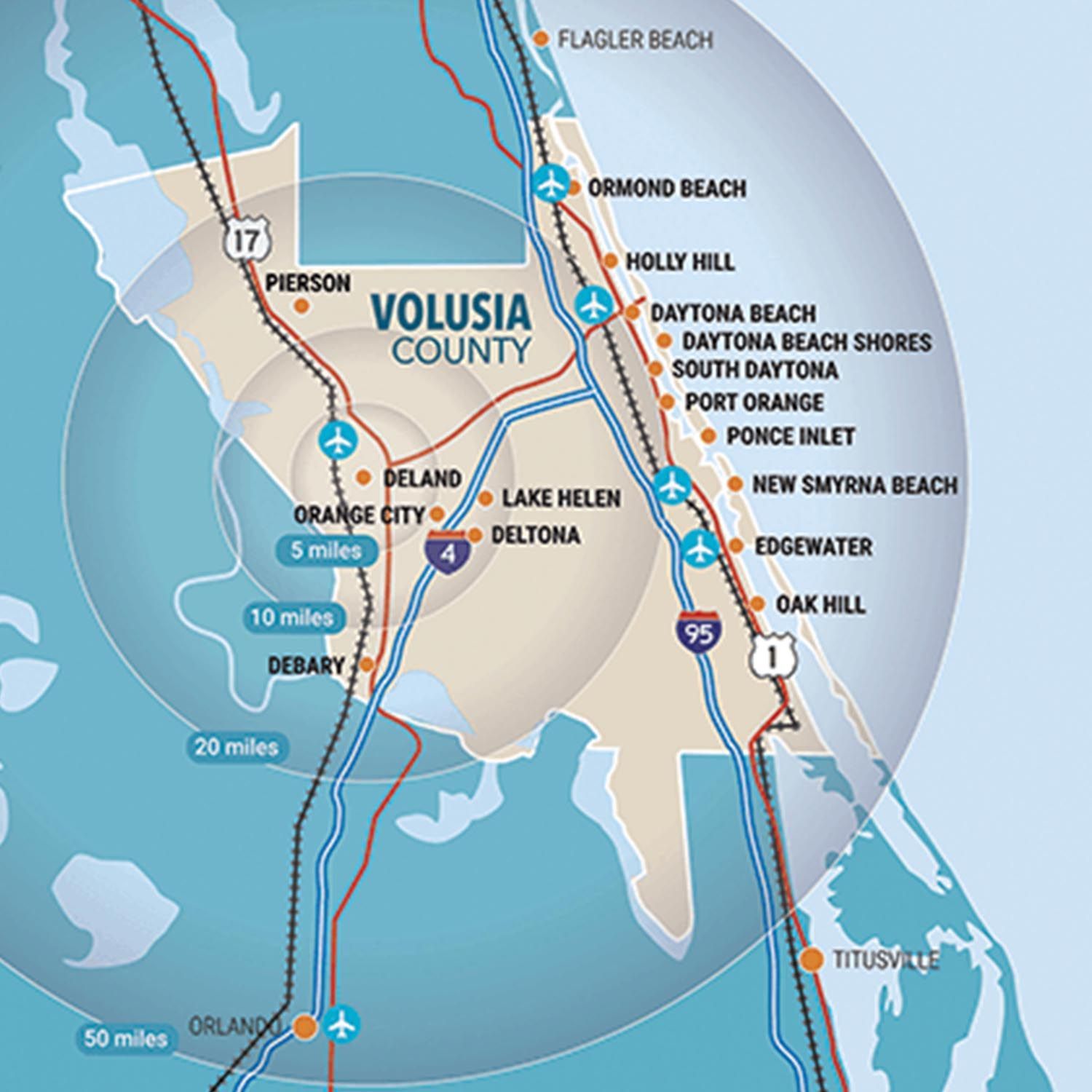

This uncertainty might be the hardest part: not knowing if, or when, the foreclosure might finally come knocking. Will they kick you out and move your stuff to the curb? The truth is, we can't say for sure because it largely depends on your lender and the efficiency of their attorneys. Here in Volusia County Florida, the process from Lis Pendens to final foreclosure averages around 180 days, but this can vary. What you need to know is that it's a window of time, but not one to watch passively. We understand that this is your home, your sanctuary. You probably don’t want to leave and it’s easy to ignore the situation you’re in!

However, please understand this—although you’re in a tough situation, it's essential not to panic and make hasty decisions out of fear. Yes, investors will be calling, knocking, and begging to buy your house. But before you give up your hard-earned equity, we urge you to pump the brakes. Stop, because you have options! In this letter, (yes, it is pretty long) we’re going to share a ton of helpful tips and information. You’ll read about several programs that most people don’t know about. Our hope is that we can spare you the stress, grief, and pain that comes from foreclosure.

So Why Listen to Us?

Of course, you’re probably wondering why we’d openly and freely share this information and be willing to help. We believe in transparency and want to be honest from the start…Yes, we are home investors, but not like you’ve seen before. Actually, everything we do comes from a different heart as compared to the heaps of mail landing on your doorstep. Our motto is “investing in people, and partnering on properties.” So actually, we DON’T want to buy your house for cash! Furthermore, if we ever work with you, it would be as partners, side by side. What you might not realize just yet is that both of us, Matt and Bill, (Owners of A First Class Investments) have walked in your shoes. Yes, some years back, we both lost homes to foreclosure, grappled with bankruptcy, and faced some dark days. So, we get it and understand the rollercoaster of emotions you're riding. Whether you choose to connect with us or not, please know this: you’re going to weather this storm and these dark days will pass.

It’s Time to Stop What You’re Doing

and Read this Letter!

Because we’ve been there, we know the pressure is mounting and every ticking second feels like an echo in an empty room. But here’s the thing—rushing now could cost you dearly later on. You might feel overwhelmed by the flurry of offers and decisions you need to make, but we promise, taking a moment to understand your options can save you not just money, but heartache and regret. We shared that we went through some hard times in our past, but just as we recovered, so will you! Today, our team is made up of licensed builders, real estate agents, and we all have extensive experience in the mortgage business. Better yet, we’ve stood beside dozens of Volusia County residents who were once in your shoes. So, yes, we’ve seen every side of this industry. However, if you jump at the first “quick fix” that comes your way, you might land in even murkier waters. So our advice is straightforward. Take a deep breath, get comfortable, and allow us to show you a few different paths. Trust in the expertise of people who genuinely want to help. Your home, and your peace of mind, are worth that pause.

There are Multiple Ways to Save Your Home…

Without Selling It or Getting Foreclosed On!

Prepare yourself, because we're about to dive deep. This letter is full of insights, strategies, and solutions for saving your home. If selling is on your mind, we’ll share more about our unique partnership programs later in this letter. However, we urge you to read this segment first. You already know some of our personal stories—facing the shadows of foreclosure. But there’s more to us than just those experiences. Because of our experience in the industry, the people we’ve helped, and the hard times we’ve endured, we know how the system (and your lender) work. So, the knowledge we're about to unpack here will be instrumental if you’re looking for ways to save your home and stop foreclosure. And if you do plan on selling, you’ll also see that you have plenty of options there as well. You’ll find some QR codes on the following pages. The QR codes link over to our website. Just grab your cell phone and scan them with your camera. Ready to dive in? Let’s start with your mortgage.

Mortgage Hacks and Refinance Options

With the right knowledge, the walls you feel closing in might just move apart. Believe it or not, there are some effective strategies to work alongside your lender to potentially save your home. But you have to be willing to pick up the phone and make some calls! If you’re shy, this might be tough, but we promise you, your bank doesn’t want your home. They just want their money. The first thing you should try is getting a Loan Modification. This approach is about more than mere paperwork—it's a potential lifeline, giving you the chance to rework the terms of your mortgage, possibly to more favorable conditions. Then there's Refinancing, an avenue you may have found impossible with your current lender or some banks. But they aren’t the only source of money. You need to talk to a mortgage broker with multiple funding sources. Depending on the equity you have in your home, you could secure a new loan with better terms. Even if the rate is higher, what if you could consolidate debt, and reset the clock? Ever heard of Forbearance Agreements? They temporarily allow you to reduce or pause payments, giving you that much-needed breathing room. Repayment Plans are yet another tool, letting you catch up on missed payments over time without overwhelming pressure. And lastly, for eligible seniors, Reverse Mortgages can convert home equity into cash, allowing them to stay in their homes while receiving funds. We just covered a lot in this short section. If you want to learn more, simply scan this QR code to learn more about these options. Remember, we told you this letter would be the most honest letter you’d ever receive. You don’t have to sell to investors… If you do sell, we hope you consider our options, but our first goal is to help because we invest in people first!

Widely Unknown Government Programs to

Stop Foreclosure Dead in its Track

Some lenders aren’t helpful and don’t offer forbearance or repayment plans. But you still have a few aces up your sleeve, courtesy of the federal government. The Home Affordable Modification Program (HAMP) is one such gem. It's not just another bureaucratic initiative; it’s a tailored solution designed with you in mind. Through HAMP, loans are reshaped, transforming them into more manageable monthly payments. But why stop there? The Home Affordable Refinance Program (HARP) can be your guiding star if your home's value has dipped. With it, homeowners can refinance their mortgages, circumventing the pitfalls of depreciated home values. But the real secret weapon in this arsenal? Partnering with a HUD-approved housing counselor. Under the banner of the U.S. Department of Housing and Urban Development, these wizards of the housing world can decode the labyrinth of defaults, and foreclosures. They're not just counselors—they're your allies in the trenches, negotiating with lenders and pinpointing the options that suit you best. These tools and resources may be your golden ticket to stop foreclosure. To learn more about these government programs, scan the QR code. Remember, your home isn’t just bricks and mortar; it's where your story unfolds. And every story is worth a fighting chance.

Legal Help - Why Lawyering Up

Might Be a Good Option

Another shield to stop foreclosure is a legal one. You might not have considered this, but it’s worth exploring. You don’t have to become an expert in legal jargon, but understanding a few rules of the game will ensure everyone, especially your lender, plays fair. First and foremost, scrutinize the paperwork. It might seem tedious, but believe it or not, sometimes lenders slip up. We’ve seen it! Errors can occur in mortgage documents or in the foreclosure process itself. If something feels off, hiring a keen legal eye can spot these discrepancies. There’s also the avenue of bankruptcy. We know this isn’t an easy decision, (because we’ve been there—and yes, it sucks) and bankruptcy might not be suitable for everyone, but filing can halt the foreclosure process in its tracks. This isn’t about evading responsibilities but buying some time to reevaluate and perhaps restructure or eliminate other debt. If you’re facing crushing debt due to a loss of income and have little assets, bankruptcy might be a life saver. If you qualify, you may be able to keep your home and all of your equity. Remember, we’re not attorneys, and this letter isn’t offering legal advice, we’re just sharing ideas you should consider. Scan the QR code to learn more about your options and find some attorneys who help with bankruptcies and foreclosures in Volusia.

Turning to Your Community: Volusia Resources to Navigate Foreclosure

In times of adversity, sometimes the most potent support comes from right next door. And yes, there are places right here in Volusia that help those going through hard times! Many nonprofits dedicate their resources to ensuring that residents don’t lose their homes. They can help with housing payments, ensuring that a short-term setback doesn’t result in a long-term loss. Additionally, some are specifically tailored to assist with rents, ensuring that even if you're in transition, you have a safe space for yourself and your loved ones. But it's not just about bricks and mortar. Life's pressures can stretch thin your resources, and that's where local food pantries step in. They provide not just sustenance but also a sense of community, reminding you that you're not in this fight alone. Reaching out for help isn't a sign of weakness—it's a testament to your resilience. Check out some of these local heroes and how they can assist by scanning this QR code, and let us introduce you to the many hands ready to pull you back to your feet.

A Few Other Options You

Might Not Have Considered

When navigating through the stormy seas of potential foreclosure, sometimes the solutions are closer to home than we might think. Let's dive deep and explore some avenues you might have overlooked. Firstly, family. It's that ever-present network that, more often than not, provides an emotional safety net during trying times. While the idea might seem daunting, perhaps even a touch embarrassing, reaching out to family members might just be the lifeline you need. Swallowing our pride and asking for assistance can be difficult, but you might be surprised at the lengths your loved ones are willing to go to help you save your cherished home. Next up, is the material world. You'd be amazed at the potential treasures lying dormant in your life. Think about assets you might sell for the greater good. It could be an extra vehicle, an old piece of jewelry, a vintage collectible, or even a life insurance policy. Lastly, there's a world of opportunity out there waiting to be tapped into. We’re talking about earning extra income! Ever thought of renting out a room on Airbnb? It might sound unconventional, but the gig economy offers ample chances to make a quick buck. Whether it's delivering meals with DoorDash, driving around town as an Uber driver, or any other side hustle you might think of, there's potential to bridge the financial gap. Feeling intrigued? We've only just scratched the surface. We’ve created a whole bunch of ways you could add extra income and potentially save your home. Just scan the QR code to learn more. Pretty helpful right?

Shifting Gears: When All Else Fails, Know That Selling is Okay Too.

There comes a moment in life when the storm feels too intense, the weight too heavy, and the path forward is just too hard. We have stood with countless individuals who've walked on this tightrope of foreclosure. If you've tried every avenue and still find yourself in the eye of the storm, or if you're leaning towards selling, we want you to understand that it's perfectly okay. Sometimes, letting go can be the most empowering decision you make. By choosing to sell, you can give yourself a fresh emotional start. Beyond the mental relief, selling can also be a financial lifeboat. It offers an opportunity to consolidate debt, reset your financial compass, and carve a new path forward. If you’re thinking about selling, the next part of this letter will be very helpful. So, let’s talk about your options.

Working with Investors, Realtors, or

Selling by Owner

Considering selling to an investor? Or maybe you’re thinking about doing it yourself as a For Sale by Owner… Hold on to those thoughts for a moment. It’s true, some investors bring forth quick cash deals, and yes, you could try to sell your home yourself. However, before dumping your house to an investor or grabbing a yard sign, we encourage you to first consider this—You’re likely to net much more money by listing your home with a licensed real estate agent or REALTOR. Even if your home has seen better days, remember every property has value. And with the record real estate appreciation in recent years, your home may be worth more than you think! Listing your house for sale with a Realtor harnesses their expertise to ensure you get the maximum return on your investment and prevent foreclosure. We, as experienced real estate investors, always sell our partner homes through Realtors. Consider this—If we know what we’re doing and still use licensed real estate agents, you probably should too unless you have extensive experience in real estate. If you’re looking for some of the lowest commissioned Realtors who understand foreclosures and how they work, we’re happy to connect you with the agents we use. Just send a quick text to 386-603-1234 and let us know you received our letter and are looking for an agent. Remember, we’re here to help even if you don’t partner with us on your home. Unfortunately, sometimes there isn’t time to wait 60-90 days for your house to sell. You also might be in dire need of cash. So, if you’re leaning towards selling to investors, keep reading. This is where you’ll see how A First Class Investments can become your partner!

A BREATH OF FRESH AIR – HOW WE’RE DIFFERENT

Let's get one thing straight right out of the gate—if you're feeling inundated by the barrage of "we buy houses for cash" promises, you're not alone. Too many homeowners feel like they are targeted as prey in a market flooded with investors ready to swoop down. We think that stinks! Actually, one of the reasons we got into this business was because of the surplus of unethical and predatory investors. Get ready, because we do things differently. You’ll learn more about our programs soon, but here’s who we are at our core and why we hope you’ll consider working with us!

First of all, remember the word partnership! It means a lot to us! Because once you’re qualified as a partner (3-5 Days), you’ll see we work with speed and agility. We understand that you’re likely in need of cash. We get it! Remember, we’ve been there before. Within a week, we can provide you with as much as $20,000 in cash. We’ll also bring your loan current and pay all of your utilities. Again, this is all part of a partnership. This doesn’t mean you’ve sold us the house, it means we’ve become contractual partners. Thankfully, you’ll see our contracts resonate with honesty and transparency. They are simple and clear without hidden games or gimmicks.

Remember, we’re local, not some distant corporation writing from Miami or Tampa. We are your neighbors. We grew up here! We live here and are proud to call Volusia County our home. When you partner with us, you’ll have the chance to meet face-to-face. Our partnerships provide way more value than what most investors offer. Need assistance relocating? We’ve got you covered! From helping you find a rental to assisting with the moving process itself, we can help. You’ll find that our expertise in renovations ensures that your property's value is maximized. We also use Realtors that offer the lowest commission. Why does any of this matter? Because you’re a partner! And our goal is to help you make the most money as possible on your home. It might sound crazy, but we follow an old principle called the Golden Rule. We aim for professionalism, kindness, and an unwavering dedication to treating our partners the way we’d want to be treated.

And communication? We believe it's the bridge to trust. Throughout our partnership, we’ll not only keep the lines of communication open but will also educate you about each step of the process. Perhaps the cherry on top is our unique offer, allowing you to continue residing in your cherished home for up to an entire year depending on the program you select and the equity in your home. We understand the emotional ties one has to their dwelling, and we respect that bond. If you’re still reading, then here comes the good part! Let’s dive into our 3 programs.

Introducing Program One

A First Class Partnership

Partnerships are built on trust. And we aim to be a partner that you know, like, and trust. The goal of our partnership program is to create an alliance where both parties emerge victorious. Imagine if there was a solution that provides you with substantial and immediate financial relief coupled with a promise of even bigger returns in the near future. That’s what our partnership means!

Let’s dig into the program. First and foremost, we get the ball rolling quickly by giving you up to $20,000 in just seven days. No waiting, no crazy negotiations. We then set about rectifying your mortgage situation by bringing it current. To further ease your burdens, we'll take care of all utility bills. Whew! You’re going to feel better quickly. Now, remember this partnership is based on selling the home. But the good news is that we don’t have to rush. We’ll even provide assistance for your relocation, ensuring a smooth transition. Now, for the real magic—instead of leaving your house in its current state and selling it for a lower price, we'll fully renovate it at no additional cost to you. That's right, our team (remember we’re licensed builders) will breathe new life into your home (at a very low cost), transforming it into a property that attracts top-dollar offers. Once the rejuvenated house is listed and sold, we don't walk away with all the money. Instead, we split the proceeds with you…our partner.

The result? You gain instant financial relief up-front, followed by a substantial payoff when the home sells. You are part of the process and in most cases, you’ll generate more income overall than just dumping your home to an investor. Of course, this program comes with many intricate details and additional benefits. While this letter provides a quick snapshot, we’ll dive in deeper during your initial phone conversation. We use this program with most homeowners facing foreclosure because of its perks and benefits. Needless to say, it’s our flagship and most sought-after offering. If you're seeking a blend of immediate relief and a lucrative future, this program could be your golden ticket.

Program Two – You Stay, We Pay

Life often throws us curveballs. Maybe you’ve just hit a bumpy spot. We hate that. Another option is our 'You Stay, We Pay' program. This unique solution is tailored for those who need financial relief so they can get back on their feet. This is for those who aren’t ready to let go of their home just yet. You already know that most investors aim to purchase your property and get you out as fast as possible. We do things differently. Here's how it works—In this program, we will buy your house, but instead of ushering you toward the door, we welcome you to stay. Think of this as a blend of selling your home and renting it back. It's essentially converting your homeownership into a stress-free rental, with a twist.

During the first phase, we can provide you with a financial lifeline by giving you up to $20,000 within a mere seven days. Your mortgage woes? Gone! We handle everything by bringing payments current or perhaps paying off your home. And for the next year, you may be able to push aside concerns about utility bills or rent payments. Obviously, this all depends on the equity in your property, but if we can, we’ll shoulder those burdens for you. Yes, you read that right. You could continue to live in your home without the weight of any financial responsibilities. But that's not where our commitment ends. When the lease term wraps up, which you would agree to in advance, you're at the steering wheel. You can choose to reclaim homeownership by repurchasing the home at an agreed-upon price. Alternatively, if you decide to embark on a new journey elsewhere, not only do we facilitate the move, but we also present you with another lump sum of cash as part of your partnership agreement. A parting gift, if you will.

As you can imagine, this program is unique and every situation is different. We're more than happy to explore this in depth with you, ensuring clarity and mutual understanding. Our 'You Stay, We Pay' program stands as a testament to our commitment to flexibility, ensuring homeowners have options that truly resonate with their needs and desires. If the allure of staying put while enjoying financial peace sounds appealing, this might just be your ideal path.

Program Three – The Quick Sale

Lastly, you might want to just be done with it all! For homeowners seeking an uncomplicated and speedy resolution, our 'Quick Sale' option offers a streamlined pathway out of the foreclosure maze. At its core, this is selling your house to us. At the same time, our motto is to invest in people, so there are some great benefits to working with us.

Even with the ‘Quick Sale’ program, we’ll be here to journey with you every step of the way. From helping to facilitate your move, to taking on the mantle of handling necessary home repairs, our approach eliminates the typical hassles homeowners grapple with during a sale. One of the standout features of this option is our commitment to quick action. We're talking about a hefty cash deposit in your hands coupled with a closure timeline that can be as swift as 15 days. This ensures you have the financial backing and time frame you need to transition smoothly into your next chapter. If speed, simplicity, and support are your priorities, the 'Quick Sale' might be the exact solution you're seeking.

You’ve Read the Letter… Now What!

It was a lot, but you made it through. First off, thanks for reading! We truly hope the insights and resources we've shared have been of value to you. From understanding how to navigate foreclosure, to presenting potential solutions that might fit your unique situation, our aim has been to light a path in what can often feel like a dark journey. We've poured our hearts into this letter, not just as professionals, but as people who have encountered the same hurdles you're facing now. We understand, firsthand, the weight of the decisions before you. We hope you know that we’re here to help and that we’ll do our best to support you every step of the way. If you’re interested in learning about our programs, the next step is easy. Just reach out when you’re ready. A quick conversation is all it takes to get started. You can call us or text us at 386-603-1234. We're only a call away, ready and eager to assist you.

A Few Final Words of Friendly Advice.

Doing nothing and expecting a different result is what Albert Einstein labeled as insanity. We can't stress this enough—please don’t let the bank take your home back! Be proactive! Do everything you can! Be educated and make informed decisions. Use this letter as a guide and do what you have to do to save your home! You’ve received this letter today. But guess what? So did hundreds of others. The truth is, we’ve worked hard on our programs and designed them to be innovative and helpful. Because of our history and experience, we also know that our unique partnership opportunities may have sparked your interest. Let us encourage you that if you’re intrigued, even just a little, please don’t delay. Call or text us today! Why? Because every time we send out these letters, our phones start ringing like crazy. We're likely already talking to several others in your same situation. We have capital to invest, but it isn’t unlimited. We wish we could tell you that we’re able to partner on every house, but that’s just not the truth. We can only partner with a select number of homeowners each time these letters go out, so if you’re even slightly interested, it’s best to take action.

Please understand that this isn’t a sales pitch—it's the reality of our situation. It would be truly heartbreaking for us to hear from you after getting scammed by an unethical investor or worse yet, to hear you’ve lost your home to foreclosure. So, please, if you see a glimmer of hope in what we offer, give us a call. We’re here, waiting, and hoping to help. And if you’re not interested in partnering, and your goal is to keep your home and avoid foreclosure, please know that we’re sincerely cheering for you. Furthermore, we hope you use our website and resources in this letter to keep your house!

Your Friends on the Journey,

Matt & Bill

A First Class Investments, LLC

Volusia County Florida

386-603-1234 (Call or Text)